Investing NOK 20 billion in new projects on the Norwegian continental shelf

New technology and project improvements trigger new investments on the Njord and Bauge fields in the Norwegian Sea. Statoil, on behalf of the partnerships in the licences, today submits the plans for the development projects to the Norwegian minister of petroleum and energy, Terje Søviknes.

“When we submitted the plan for development and operation for the Njord development 20 years ago we assumed that the field would be shut down in 2013. With new technology, project improvements and close cooperation with the partners and supply industry, we now see opportunities to create considerable value for another 20 years at Njord”, says Margareth Øvrum, Statoil’s executive vice president for Technology, Projects and Drilling.

It is a revised plan for development and operation of the Njord field and a plan for development and operation of the new Bauge field that were submitted to Norwegian authorities today.

Capital expenditures for both fields total NOK 19.8 billion (Njord NOK 15.7 billion, and Bauge NOK 4.1 billion).

“The Njord and Bauge development projects bring new opportunities for the supply industry. Both the Njord A platform and the Njord Bravo floating storage and offloading vessel (FSO) will be upgraded. In addition, we will build new subsea facilities, drill new wells and perform extensive marine operations,” says Øvrum.

Further development of the Njord area, including upgrading of the Njord installations and development of the Bauge field, is important to the industry in Mid-Norway and further development of the Norwegian continental shelf.

“Njord remaining on stream until 2040 is important for our specialist communities in Kristiansund and Stjørdal, as well as Mid-Norway supply industry. An upgraded field centre and new infrastructure at Njord will facilitate the development also of other fields in the area,” says Siri Espedal Kindem, Statoil’s senior vice president for operations North in Development and Production Norway.

The work performed on the Njord A platform at Kværner Stord will facilitate the tie-back of Bauge, as well as potential third-party tie-ins.

New subsea technology key to the Bauge development

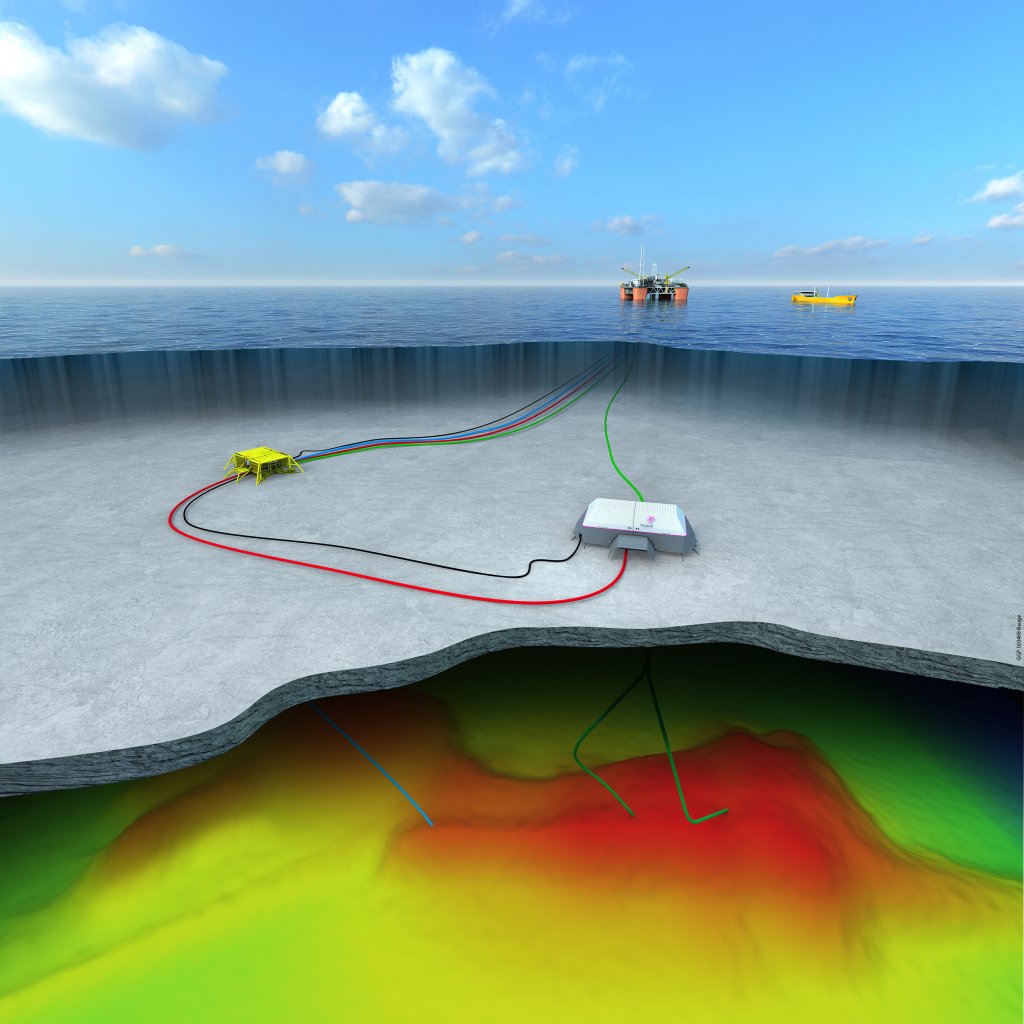

The Bauge development will be the first user of the Cap-X technology, which is a next-generation subsea production system.

“Cap-X costs less to produce and install. This helps add more value from the Bauge field,” says Øvrum.

The Njord and Bauge projects:

Njord A and Bravo will be upgraded to recover the remaining resources on the Njord, Hyme og Bauge fields.

The remaining resources on the Njord and Hyme fields total 175 million barrels of oil equivalent. This corresponds to the reserves produced on the Njord field since first oil in 1997. In addition, there are 73 million barrels of oil equivalent at Bauge.

The Bauge field development concept includes one subsea template, two oil producers and one water injector. The Bauge resources will be phased in to the Njord A platform. This alone helps increase the life of the Njord field by three years.

Both projects will come on stream at the end of 2020.

- First oil in 1997

- Njord has been on stream for 6821 days, and 54 wells have been drilled so far

- 10 new production wells are planned on the field

- In 2016 the Njord A platform and the Njord Bravo FSO were towed ashore, to Stord and Kristiansund, respectively

- Reserves: 175 million oil equivalent

- Capital expenditures: NOK 15.7 billion

Partners: Statoil (operator) 20%, Engie E&P Norge AS 40% (20)*,DEA Norge AS 30% (50)*, Faroe Petroleum 7.5% and VNG Norge AS 2.5%.*

*The ownership interests will be changed in accordance with the percentage in brackets, given government approval.

- The discovery is located some 16 kilometres north-east of the selected tie-in platform, Njord A

- The development concept includes one subsea template, two oil producers, one water injector

- Reserves: 73 million oil equivalent

- Capital expenditures: NOK 4.1 billion

Partners: Statoil (operator) 35, ENGIE E&P Norge AS 20 (10)*,Point Resources AS 17.5, DEA Norge AS 17.5 (27.5)*, Faroe Petroleum Norge AS 7.5, VNG Norge AS 2.5

**The ownership interests will be changed in accordance with the percentage in brackets, given government approval