Statoil takes over operatorships and equity in the Martin Linge field and Garantiana discovery

Statoil and Total have agreed on a transaction whereby Statoil will acquire Total’s equity stakes in the Martin Linge field (51%) and the Garantiana discovery (40%) on the Norwegian continental shelf (NCS). Statoil will take over both operatorships and pay Total a consideration of USD 1.45 billion.

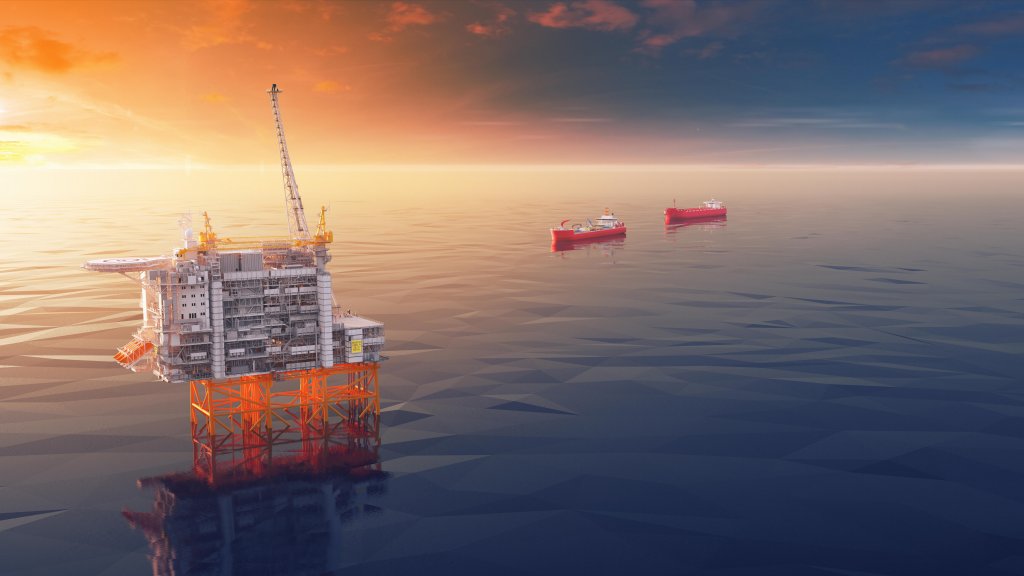

When in operation, Martin Linge will be a modern production facility with low production cost and low carbon footprint. As a result of the transaction, Statoil will also receive remaining tax balances with a nominal post-tax value of more than USD 1 billion.

“This transaction adds competitive growth assets to our portfolio on the Norwegian continental shelf. The Martin Linge project features innovative solutions to enhance safety, capture value and reduce emissions, in line with our strategy. By leveraging Statoil’s operational experience and existing contracts, we can realise additional opportunities and synergies from these assets,” says Arne Sigve Nylund, Statoil’s executive vice president for Development & Production Norway.

Martin Linge is an oil and gas field under development west of the Oseberg field in the North Sea, with estimated recoverable resources in excess of 300 million barrels oil equivalent. The expected production lifetime extends into the 2030s.

Martin Linge is being developed with a manned wellhead platform. The jacket substructure is already installed on location in the North Sea, while the topside is being completed at the Samsung yard in South-Korea and will be transported to Norway early 2018. The project has experienced schedule delays and cost increases due to delayed topside engineering, construction and currency impact. A tragic accident at the yard in May 2017 also had consequences for the progress of the project. The current operator expects start of production in the first half of 2019. Recoverable resources have increased since the initial Plan for Development and Operation due to additional resources discovered.

Operations will be controlled remotely from an onshore digital operations centre, enabling reduced operational expenditures. Electrification is made possible through a 160 km cable from shore, the longest AC power link in the world. This will reduce CO2 emissions by 200,000 tonnes per year. Following completion of the transaction, Statoil will increase from 19% to a 70% interest in the field.

Garantiana is an oil discovery north of the Visund field in the North Sea with a recoverable resource potential between 50 to 70 million barrels oil equivalent. Development concepts are currently being evaluated. Following completion of the transaction Statoil will have a 40% interest in the discovery.

Statoil will take over relevant employees from Total in accordance with the applicable legislation including required information and consultation process.

The transaction is subject to certain conditions, including government approval.

The agreed purchase price is based on an effective date of 1 January 2017. At completion of the transaction in 2018, the amount payable will be subject to adjustment. Statoil will take over as operator upon closing of the transaction in 2018.