Breidablikk coming on stream ahead of schedule

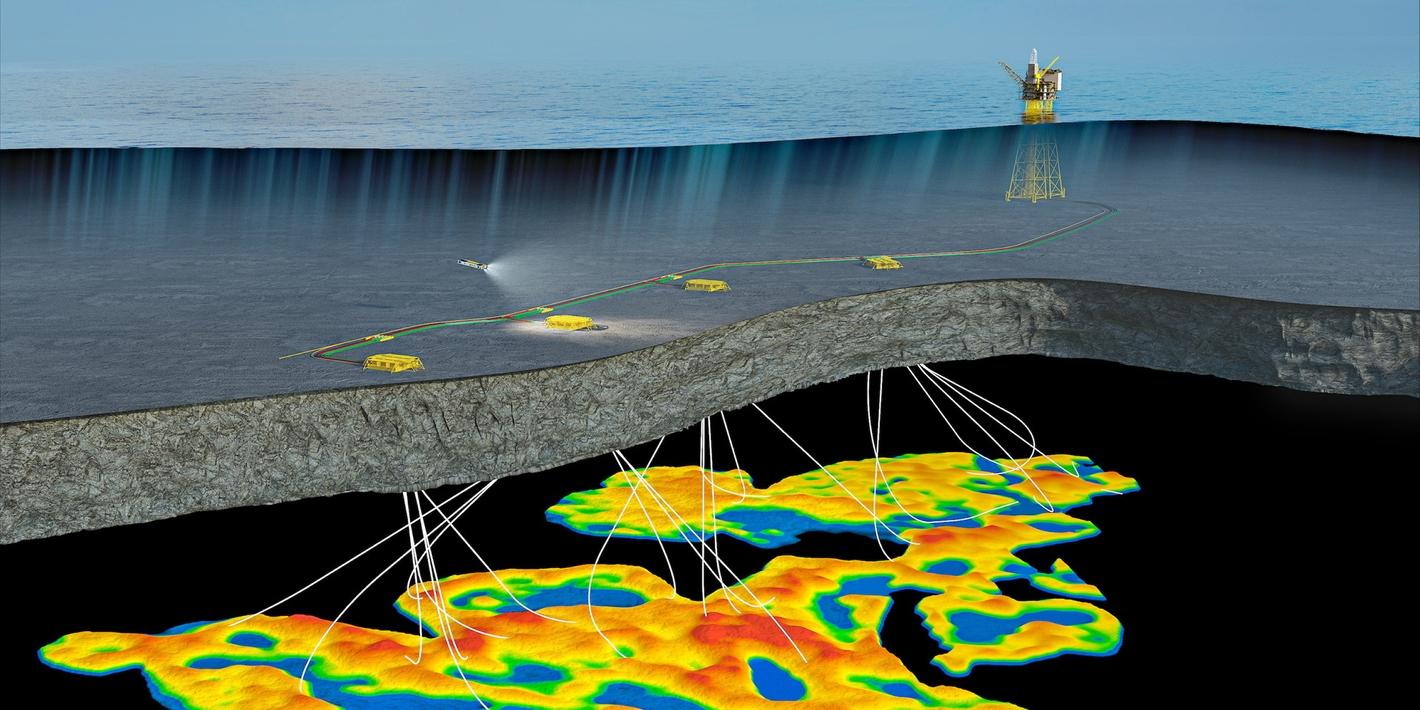

Production from the Breidablikk field in the North Sea started on 20 October, four months ahead of schedule and within budget. Tied back to the Grane platform, the subsea field holds almost 200 million barrels of recoverable oil. The partners are Equinor (operator), Petoro, Vår Energi and ConocoPhillips.

"Breidablikk will come on stream four months ahead of schedule, within budget, and with higher initial production than expected. The project is highly profitable, provides important volumes to the market, and will create great value for Norwegian society and the owners. Nearly five million working hours have gone into the project. I am proud of the project delivery, and would like to thank everyone involved," says Geir Tungesvik, Equinor’s executive vice president for Projects, Drilling & Procurement.

When the plan for development and operation (PDO) was submitted in September 2020, production from Breidablikk was scheduled to start in the first half of 2024, with predrilling and completion of five wells. Now, eight wells have already been drilled, and the drilling of additional wells will continue on the field until the end of 2025.

Breidablikk is being developed with 22 subsea wells drilled from four templates. Pipelines and cables have been installed between the subsea facility and the Grane platform, which has been modified to receive the well stream.

The project has had major ripple effects in Norway. More than 90 percent of the contract value has gone to suppliers with a Norwegian billing address. The main suppliers are Odfjell Drilling in Bergen, Aker Solutions, with large deliveries from Egersund, Wood Group in Sandefjord, and TechnipFMC, from their spoolbase in Orkanger.

Investments in the project are expected to be just over NOK 21 billion (2023 value).

"Breidablikk can help to extend the productive life and the approximately 1000 jobs associated with the operation of the Grane field towards 2060. By utilising existing infrastructure both offshore and onshore, this is a cost-effective development. At peak, Breidablikk is expected to send up to 55-60,000 barrels of oil to the market daily, mainly to Europe," says Kjetil Hove, Equinor's executive vice president for Exploration and Production Norway.

The oil from Breidablikk is processed on Grane and sent ashore by pipeline to the Sture terminal in Øygarden. Oil will account for about 15 percent of exports from Sture in the years to come. The new field will be operated together with the Grane field by the Equinor organisation at Sandsli in Bergen.

Accept cookies

Want the full picture? We’d love to share this content with you, but first you must accept marketing cookies by enabling them in our cookie settings.

Latest news

Ex. dividend third quarter 2025

The shares in Equinor ASA will be traded on the Oslo Stock Exchange (OSE) and New York Stock Exchange (NYSE) exclusive the third quarter 2025 cash dividend as detailed below.

Buy-back of shares to share programmes for employees

Equinor ASA has on 4 February 2026 engaged a third party to conduct repurchases of the company's shares to be used in the share-based incentive plans for employees and management for the period from 13 February 2026 until 15 January 2027.

Notifiable trading

A primary insider in Equinor ASA has sold shares in Equinor ASA: