Transfer of Krafla operatorship from Equinor to Aker BP

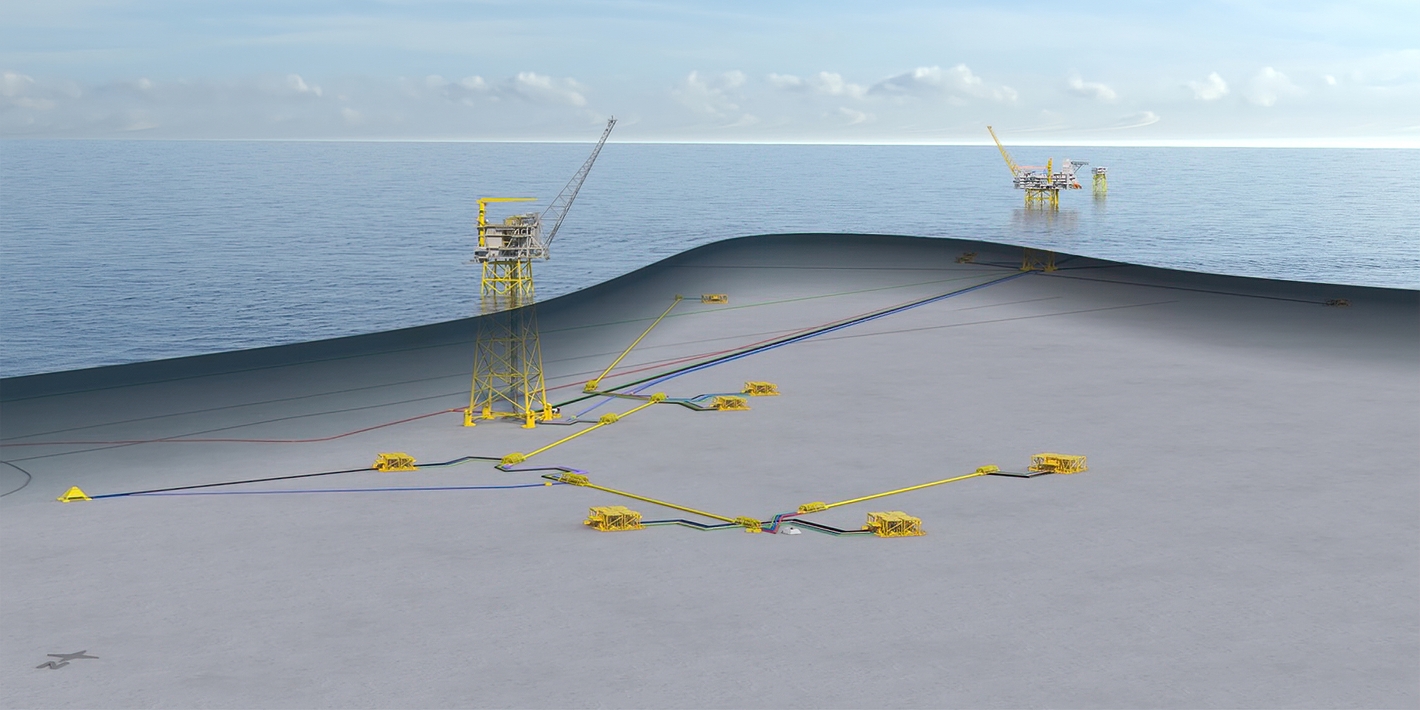

Equinor and Aker BP have signed a memorandum of understanding (MoU) for transfer of the Krafla operatorship from Equinor to Aker BP, making Aker BP the operator of all discoveries in the NOAKA area - Krafla, Fulla and North of Alvheim.

Equinor and Aker BP are operators of one field development project each in the area and have agreed that one operator will be the best solution for further development of the area.

Equinor is presently the operator of Krafla in the north and Aker BP is the operator of NOA Fulla in the south. One operator will have a good basis for efficient project execution and for safe and efficient operation of the fields, creating stronger synergies between the two developments and fewer interfaces.

“The current agreement is the result of an excellent collaboration during the past years, built on mutual trust and a common ambition of achieving lasting improvements and efficient operation on the Norwegian continental shelf (NCS). The best solution for the future is that Aker BP takes over the operatorship for project execution and operation of Krafla, based on the concept developed by Equinor,” says Geir Tungesvik, Equinor’s executive vice president for Projects, Drilling & Procurement.

Moving forward, Equinor will ensure transfer of expertise and experience relating to the Krafla concept to Aker BP and the collaboration will continue in the development phase.

“Aker BP and Equinor have had an excellent collaboration during the past years on the NOAKA development. We are proud of being able to take over the Krafla operatorship, to ensure efficient project execution and operation of the whole area on behalf of the licences,” says Karl Johnny Hersvik, chief executive officer of Aker BP.

The MoU states that the licence owners of the relevant licences will apply to the ministry for change of operator. A transfer of operatorship will be carried out when the investment decision has been approved by the licence and the plan for development and operation (PDO) has been submitted to the authorities.

Equinor will still be a major licence partner in the area and will retain its existing share of 50 per cent in Krafla and 40 per cent in the Fulla licence. The companies will jointly submit the PDOs for NOA Fulla and Krafla as planned by the end of the year.

With investments in the order of USD 10 billion the area development is one of the next big NCS developments. A high percentage of the contracts will be awarded to Norwegian suppliers, creating strong ripple effects throughout the country.

Latest news

Announcement of cash dividend of NOK 3.5249 per share for third quarter 2025

Equinor ASA announced on 29 October 2025 a cash dividend per share of USD 0.37 for third quarter 2025.

Ex. dividend third quarter 2025

The shares in Equinor ASA will be traded on the Oslo Stock Exchange (OSE) and New York Stock Exchange (NYSE) exclusive the third quarter 2025 cash dividend as detailed below.

Buy-back of shares to share programmes for employees

Equinor ASA has on 4 February 2026 engaged a third party to conduct repurchases of the company's shares to be used in the share-based incentive plans for employees and management for the period from 13 February 2026 until 15 January 2027.